FREE PERSONAL PROMISSORY NOTE TEMPLATE

A personal promissory note template serves as a written record of a personal loan or debt agreement between individuals and is often used in situations where money is being borrowed or lent between friends, family members, or acquaintances.

It is a legally binding document in which one person, referred to as the "maker" or "promisor," promises to pay a specific amount of money to another person or entity, referred to as the "payee" or "holder," on a specified date or upon demand.

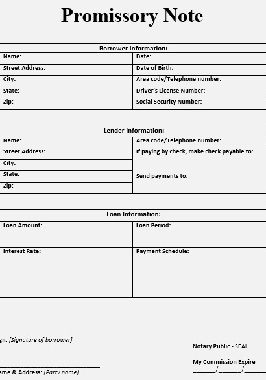

7 things you should include when writing a Personal Promissory Note Template:

- The names and addresses of both the borrower (promisor) and the lender (payee).

- The date when the promissory note is created.

- Both the borrower and the lender should sign the promissory note to indicate their agreement and acceptance of the terms.

- The specific amount of money being borrowed.

- Include the schedule for repaying the loan, including the due date or dates and the method of payment.If interest is charged on the loan, clearly state the interest rate and how it will be calculated.

- Outline what will happen if the borrower fails to repay the loan as agreed, such as additional fees, penalties, or legal action.

It is a good idea to consult with an attorney to make sure that the promissory note complies with the laws and regulations applicable in your State of residence. This will provide greater protection in case of any disputes and help to make the document legally enforceable. in your jurisdiction.

Reasons why you should write a Personal Promissory Note template:

- A written promissory note establishes a legally enforceable contract. If the borrower fails to repay the loan as agreed, the lender can use the promissory note as evidence to pursue legal action, if necessary.

- It provides clarity regarding the terms of the loan, such as the loan amount, repayment schedule, interest rate (if applicable), and any other relevant terms and conditions. Having everything in writing helps avoid misunderstandings or disputes in the future.

- When dealing with loans between friends or family members, having a formal promissory note can help maintain a sense of professionalism and trust by clearly outlining the terms of the loan.

- It serves as proof that a debt exists and that there is an obligation to repay it. This can be useful for both the lender and the borrower to keep track of financial transactions and records.

- Writing a promissory note can encourage both parties to take the loan agreement seriously and be more accountable for their financial commitments.

PERSONAL PROMISSORY NOTE TEMPLATE

(Your Name)

(Your Address)

(City, State, Zip Code)

(Date)

I, _______________________ (Borrower's Full Name), residing at ___________________ (Borrower's Address), hereinafter referred to as the "Borrower," promise to pay to __________________________ (Lender's Full Name), residing at ____________________ (Lender's Address), hereinafter referred to as the "Lender," the sum of _____________________ (Loan Amount in words e.g., "Two Thousand Dollars") ____________ ($2,000.00), with interest at the rate of ______ (Interest Rate)% per annum.

Method of Payment: All payments shall be made in ____________________ (payment method, e.g., cash, check, bank transfer, etc.) to the Lender's designated account as follows: __________________________________________ (Bank Account # and other relevant payment details).

Repayment Terms: The Borrower shall repay the loan in _____(number of installments, if applicable) equal installments, with the first payment due on ___/___/_____ (First Payment Due Date) and subsequent payments due on the same day of each month until the loan is fully repaid.

Prepayment: The Borrower may prepay the outstanding loan amount, in whole or in part, at any time without penalty.

Default: In the event of a default, where the Borrower fails to make any payment due within ___ (number of days) days from the due date, the Borrower shall be considered in breach of this agreement. The Lender shall have the right to demand immediate payment of the entire outstanding loan amount, including accrued interest, and may pursue legal remedies to recover the debt.

Entire Agreement: This Promissory Note constitutes the entire agreement between the Borrower and the Lender and supersedes any prior oral or written agreements or understandings.

Governing Law: This Promissory Note shall be governed by and construed in accordance with the laws of ____________________ (State/Country), without regard to its conflicts of law principles.

IN WITNESS WHEREOF, the Borrower has executed this Personal Promissory Note as of the date first above written.

______________________________

(Borrower's Signature)

______________________________

(Lender's Signature)

In order to ensure the document's legality and accuracy, consider having it reviewed by a legal professional in your jurisdiction.

This is just a sample, and it's essential to adapt the terms and language to suit your specific situation.

Return from Personal Promissory Note Template to Home page.

DISCLAIMER: The law will vary depending on your state and the specifics of your case. The information provided by USAttorneyLegalServices.com is intended for educational purposes only. All the content on this website should NOT be considered professional legal advice or a substitute for professional legal advice. For such services, we recommend getting a free initial consultation by a licensed Attorney in your State.